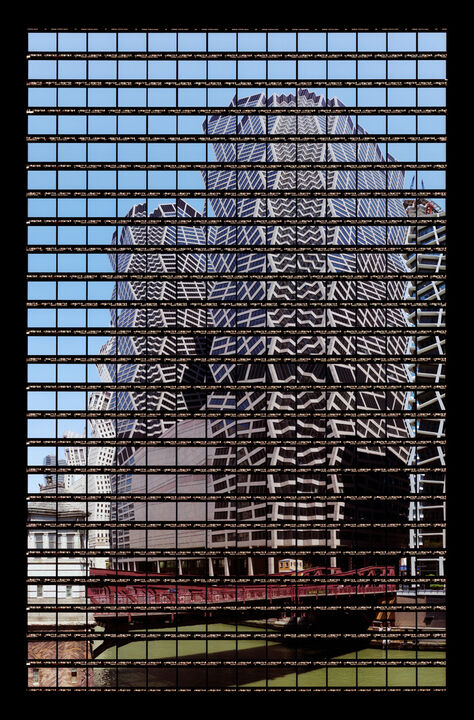

Chicago, Mercantile Exchange

In 1898 the Chicago Mercantile Exchange was founded as the Chicago Butter and Egg Board. Initially, the Chicago Butter and Egg Board traded only two types of contracts, butter and eggs. Over several decades, in 1919 it evolved into the Chicago Mercantile Exchange (CME or simply the "Merc"). The exchange demutualized in November 2000, went public in December 2002 and merged with the Chicago Board of Trade in July 2007 to become CME Group Inc. The Chief Executive Officer of CME Group is Craig S. Donohue. In March, 2008 the Chicago Mercantile Exchange bought the New York Mercantile Exchange for $8.9 billion in cash and stock. CME trades several types of financial instruments: interest rates, equities, currencies und commodities. It also offers trading in alternative investments such as weather and real estate derivatives. CME has the largest options and future contracts open interest (number of contracts outstanding) of any futures exchange in the world.